Nearly 20 years ago, there was a time that whenever my brother and I started working on one of his project cars out on the driveway that his elderly neighbor would wander over to chat. Don had a hobbled walk due to one leg being slightly shorter than the other, a result from a terrible fall while working in the oil refineries of Long Beach, California. Well into his 70’s, Don would happily argue politics, which automaker built the better car, and anything else you could toss his way.

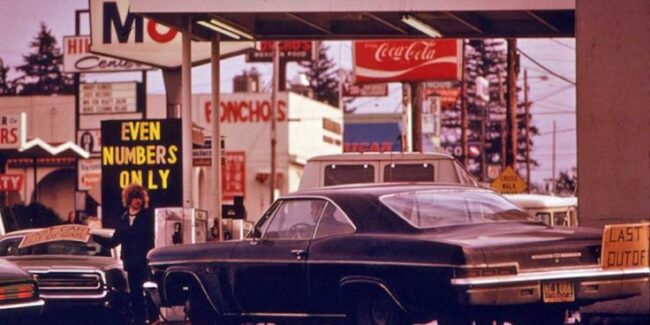

Don joked that he and all his buddies would fill up their cars at the refinery where they worked during the “gas crunch” of the 1970’s. Policies had been put in place to stave off long lines at the pump, requiring those with license plates ending in even numbers to fill up specific days, while those with odd numbers fill up on the opposite days. It was more folksy (ie. idiotic) policy from Governor Jerry “Moonbeam” Brown who gifted Californians with the anti-drought maxim, “if it’s yellow, let it mellow…”

“At the refinery, we could just get straight gas,” Don recalled. “All of that additive stuff was mixed in later. We just produced the gasoline. And we could fill up our tanks whenever we wanted. I’d fill up my truck one day, the wife’s station wagon the next. Heck, I’d drive the camper in later that week.” He snorted, “I remember one buddy towed his boat in and filled up the tank.”

“How was that possible?” I asked, visibly confused. “I thought there was a shortage?” Don roared, slapping his knee. “There was NO shortage! That’s just what they told people. There wasn’t a single day we didn’t hit our daily output. We had all the gas in the world. They just filled up the reserves while hiking up taxes.” This was my first real world insight into politics directly effecting Americans’ wallets, and sadly not much has changed.

As of this writing, the domestic average for a gallon of gas is $4.28 (according to AAA). This is $.11 less than last week and $.80 less than the all-time record high set June 14th, 2022 – just a month ago. This drop is directly attributed to an infusion of 50 million barrels of oil pulled from the United States Strategic Oil Reserve, which was originally designed to supplement areas hit by environmental disasters or times of war, and comes intentionally at the seasonal height of annual oil consumption use.

This influx of oil might’ve artificially tampered the two-year climb in the consumer cost of gasoline, but don’t expect it to last. Crude oil remains the most important commodity in the world, and a barrel of crude is $98.6 – down from $122.2, the second highest price on record set on June 8th, 2022. (The all-time record was set on March 22, 2022, at $123.7 prior to tapping into US reserves shortly thereafter.)

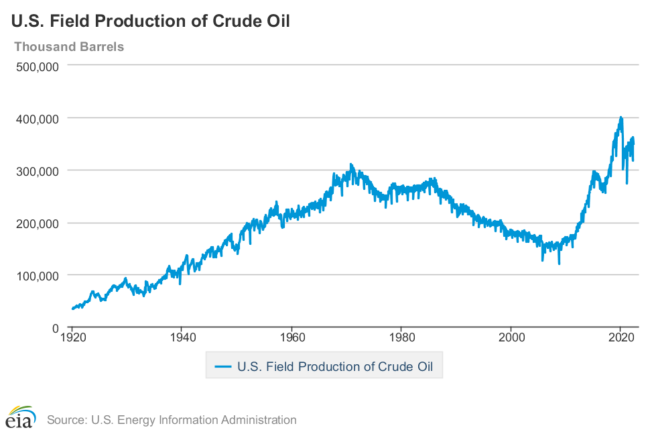

Per Market Insider, emerging Chinese and Indian oil suppliers have curbed skyrocketing prices all while OPEC production remains steady. Yet, the single biggest destabilizing player in global crude market in the past 5 years has been the United States. After a reversal of decades of US executive policy in early 2017 unleashed thousands of private and independent drilling contracts, US crude production expanded to new records:

Not since March of 1971 had US crude production surpassed 300,000 barrels a month – that is, until November of 2017; and that record was shattered two years later in December 2019 when US production broke 400,000 barrels (per the US Energy Information Administration). This 31% increase in domestic oil production replenished depleted oil reserves and earned the US the designation of “net exporter” for the first time in 80 years. But it wouldn’t last long…

As Covid swept the globe, demand collapsed. The deluge of additional oil into a rapidly shrinking market crashed the cost of crude to $3.32 a barrel the week of April 24, 2020. Oil producers quickly “eased” production throughout May and June, with US production beginning to rally to mid-2018 numbers by October. Yet, production plummeted again – this time to sub 300K levels (276K) – in March 2021 after federal drilling renewals and the Keystone XL pipeline were denied by Executive Order 13990.

The impact of Executive Order 13990 wasn’t directly felt by “Big Oil” executives either: 91 percent of the wells in the United States are operated by independent producers who generate 83 percent of America’s oil and 90 percent of America’s natural gas (per the Independent Petroleum Association of America). These companies see less than $5 million in retail sales of oil and gas a year, operate in only 33 out of 50 states and employ an average of just 12 people, reports National Review.

Since January 2021, the United States has reversed from net exporter of crude to net importer. Hundreds of drilling contracts have been denied or terminated, and millions of dollars have been lost on the development of new pipelines and refineries that were expected to replace antiquated plants (which have since closed, costing hundreds of American jobs). Thus far, current domestic production has lingered around 325K, which equals a net loss of roughly 20-percent of the total global supply from just two years earlier.

Consequently, this instability has crashed the oil investment market. ExxonMobil reported losses in four of the past ten quarters, including a massive $20.1 billion loss in December 2020 (Yahoo Finance). Certainly, ExxonMobil earning $11.8 billion during that time frame isn’t chump change, but when compared to Apple’s $211.7 billion over the same time period, it’s hard to claim “Big Oil” is really gouging consumers.

Of course, consumers visit the gas pump more often than their nearest “Genius Bar,” so the pinch feels far more prevalent. Petroleum accounts for almost all cooking heat, over 60% of domestic energy, and fuels the nation’s vast transportation network, directly effecting costs of food and goods. Thankfully, some government bodies have been helpful in providing insight as to what exactly they’re paying for. As an example, the California Energy Commission provided a cost breakdown of a $5.57 gallon of gasoline:

As of July 25th, 2022, the crude itself costs $2.52 accounting for 40% of the gallon – a price which oil companies do not set, but rather is influenced by supply and demand (detailed previously). The refining process and distribution costs add up to $2.19, making up 39% of that same gallon. The remaining costs are entirely state and federal taxes: including a state Underground Storage Tank Fee of $0.02, state and local tax of $0.12, State Excise Tax of $0.54 and a Federal Excise Tax of $0.18, or 21% of the gallon.

For those convinced that “Big Oil” continues to “stick it to the little guy” despite the provided breakdown, what are some ways to reduce the cost of their 39-percentage? Erecting new and more efficient refineries is one, which requires permits from government oversight committees. A second is employing more cost effective means of transportation of the crude to these new refineries – and that is via modern, EPA-approved pipelines, both of which Executive Order 13990 and later policies have thwarted.

Conclusively, domestic policy directly effects American crude production – positively or negatively. How to encourage production in a clean, environmentally-conscious and reliable manner is clearly debatable and should be openly scrutinized; but understanding the path to how we got to where we are is information that everyone should have. The coming years are unlikely to see dramatic improvements in energy production or decreasing costs without radical change of either policy or leadership – and that is up to the people to decide.